A world war was declared on 7 October. No news station reported on it, even though we will all have to suffer its effects. That day, the Biden administration launched a technological offensive against China, placing stringent limits and extensive controls on the export not only of integrated circuits, but also their designs, the machines used to ‘write’ them on silicon and the tools these machines produce. Henceforth, if a Chinese factory requires any of these components to produce goods – like Apple’s mobile phones, or GM’s cars – other firms must request a special licence to export them.

Why has the US implemented these sanctions? And why are they so severe? Because, as Chris Miller writes in his recent book Chip War: The Fight for the World’s Most Critical Technology (2022), ‘the semiconductor industry produces more transistors every day than there are cells in the human body’. Integrated circuits (‘chips’) are part of every product we consume – that is to say, everything China makes – from cars to phones, washing machines, toasters, televisions and microwaves. That’s why China uses more than 70% of the world’s semiconductor products, although contrary to common perception it only produces 15%. In fact, this latter figure is misleading, as China doesn’t produce any of the latest chips, those used in artificial intelligence or advanced weapons systems.

You can’t get anywhere without this technology. Russia found this out when, after it was placed under embargo by the West for its invasion of Ukraine, it was forced to close some of its major car factories. (The scarcity of chips also contributes to the relative inefficacy of Russian missiles – very few of them are the ‘intelligent’ kind, fitted with microprocessors that guide and correct their trajectory.) Today, the production of microchips is a globalized industrial process, with at least four important ‘chokepoints’, enumerated by Gregory Allen of the Center for Strategic and International Studies: ‘1) AI (Artificial Intelligence) chip designs, 2) electronic design automation software, 3) semiconductor manufacturing equipment, and 4) equipment components.’ As he explains,

The Biden administration’s latest actions simultaneously exploit US dominance across all four of these chokepoints. In doing so, these actions demonstrate an unprecedented degree of US government intervention to not only preserve chokepoint control but also begin a new US policy of actively strangling large segments of the Chinese technology industry – strangling with an intent to kill.

Miller is somewhat more sober in his analysis: ‘The logic’, he writes, ‘is throwing sand in the gears’, though he also asserts that ‘the new export blockade is unlike anything seen since the Cold War’. Even a commentator as obsequious to the United States as the FT’s Martin Wolf couldn’t help but observe that ‘the recently announced controls on US exports of semiconductors and associated technologies to China’ are ‘far more threatening to Beijing than anything Donald Trump did. The aim is clearly to slow China’s economic development. That is an act of economic warfare. One might agree with it. But it will have huge geopolitical consequences.’

‘Strangling with an intent to kill’ is a decent characterisation of the objectives of an American empire that is seriously concerned by the technological sophistication of Chinese weapons systems, from hypersonic missiles to artificial intelligence. China has achieved such progress through the use of technology either owned or controlled by the US. For years, the Pentagon and White House have become increasingly irritated watching their ‘global competitor’ make giant leaps with tools that they themselves provided. Anxiety about China was not merely the transitory impulse of the Trump administration. Such preoccupations are shared by Biden’s government, which is now pursuing the same objectives as its much-maligned predecessor – but with even more vigour.

The timing of the US announcement came just days before the opening of the National Congress of the Chinese Communist Party. In a certain sense, the export ban was the White House’s intervention in the proceedings, which were intended to cement Xi Jinping’s political supremacy. Unlike many of the sanctions imposed on Russia – which, apart from the blockade on microchips, have proven rather ineffective – these restrictions have a high likelihood of success, given the unique structure of the semiconductor market and the particularities of the production process.

The microchip industry is distinguished by its geographical dispersal and financial concentration. This is owed to the fact that production is extremely capital-intensive. Moreover, its capital-intensity accelerates over time, as the industry’s dynamic is based on a continuous improvement of ‘performance’: i.e. of the capacity to process ever more complex algorithms whilst reducing electricity consumption. The first solid integrated circuits developed in the early 1960s had 130 transistors. The original Intel processor from 1971 had 2,300 transistors. In the 1990s, the number of transistors in a single chip surpassed 1 million. In 2010, a chip contained 560 million, and a 2022 Apple iPhone has 114 billion. Since transistors are always getting smaller, the techniques for fabricating them on a semiconductor have become increasingly sophisticated; the ray of light which tracks designs must be of a shorter and shorter wavelength. The first rays used were of visible light (from 700 to 400 billionths of a metre, nanometres, nm). Over the years this was reduced to 190nm, then 130nm, before reaching extreme ultraviolet: only 3nm. For scale, a Covid-19 virion is around ten times this size.

Highly complex and expensive technology is necessary to attain these microscopic dimensions: lasers and optical devices of incredible precision as well as the purest of diamonds. A laser capable of producing a sufficiently stable and focused light is composed of 457,329 parts, produced by tens of thousands of specialized companies scattered around the world (a single microchip ‘printer’ with these characteristics is worth $100 million, with the latest model projected to cost $300 million). This means that opening a chip factory requires an investment of around $20 billion, essentially the same amount you would need for an aircraft carrier. This investment must bear fruit in a very short amount of time, because in a few years the chips will have been surpassed by a more advanced, compact, miniaturized model, which will require completely new equipment, architecture and procedures. (There are physical limits to this process; by now we’ve reached layers just a few atoms thick, which is why there’s so much investment in quantum computing, in which the physical limit of quantum uncertainty below a certain threshold is no longer a limitation, but a feature to be exploited.) Nowadays, most semiconductor firms don’t produce semiconductors at all; they simply design and plan their architecture, hence the standard name used to refer to them: ‘fabless’ (‘without fabrication’, outsourcing production). But these businesses aren’t really artisanal firms either: to give but three examples, Qualcomm employs 45,000 workers and has a turnover of $35 billion, Nvidia employs 22,400 with revenues of $27 billion, and AMD 15,000 with $16 billion.

This speaks to the paradox at the heart of our technological modernity: increasingly infinitesimal miniaturization requires ever more macroscopic, titanic facilities, so much so that the Pentagon can’t even afford them, despite its annual budget of $700 billion. At the same time, it requires an unprecedented level of integration to put together hundreds of thousands of different components, produced by different technologies, each of which is hyperspecialized.

The push towards concentration is inexorable. The production of machines which ‘print’ state-of-the-art microchips is under the monopoly of a single Dutch firm, ASM International, while the production of the chips themselves is undertaken by a restricted number of companies (which specialize in a particular type of chip: logic, DRAM, flash memory or graphics processing). The American company Intel produces nearly all computer microprocessors, while the Japanese sector – which did extremely well in the 1980s before entering a crisis in the late 90s – has now been absorbed by the American company Micron, which maintains factories across Southeast Asia.

There are, however, only two real giants in material production: one is Samsung of South Korea, favoured by the US during the 1990s to counter the rise of Japan, whose precocity before the end of the Cold War had become threatening; the other is TSMC (Taiwan Semiconductor Manufacturing Company; 51,000 employees with a turnover of $43 billion, and $16 billion in profits), which supplies all the American ‘fabless’ firms, producing 90% of the world’s advanced chips.

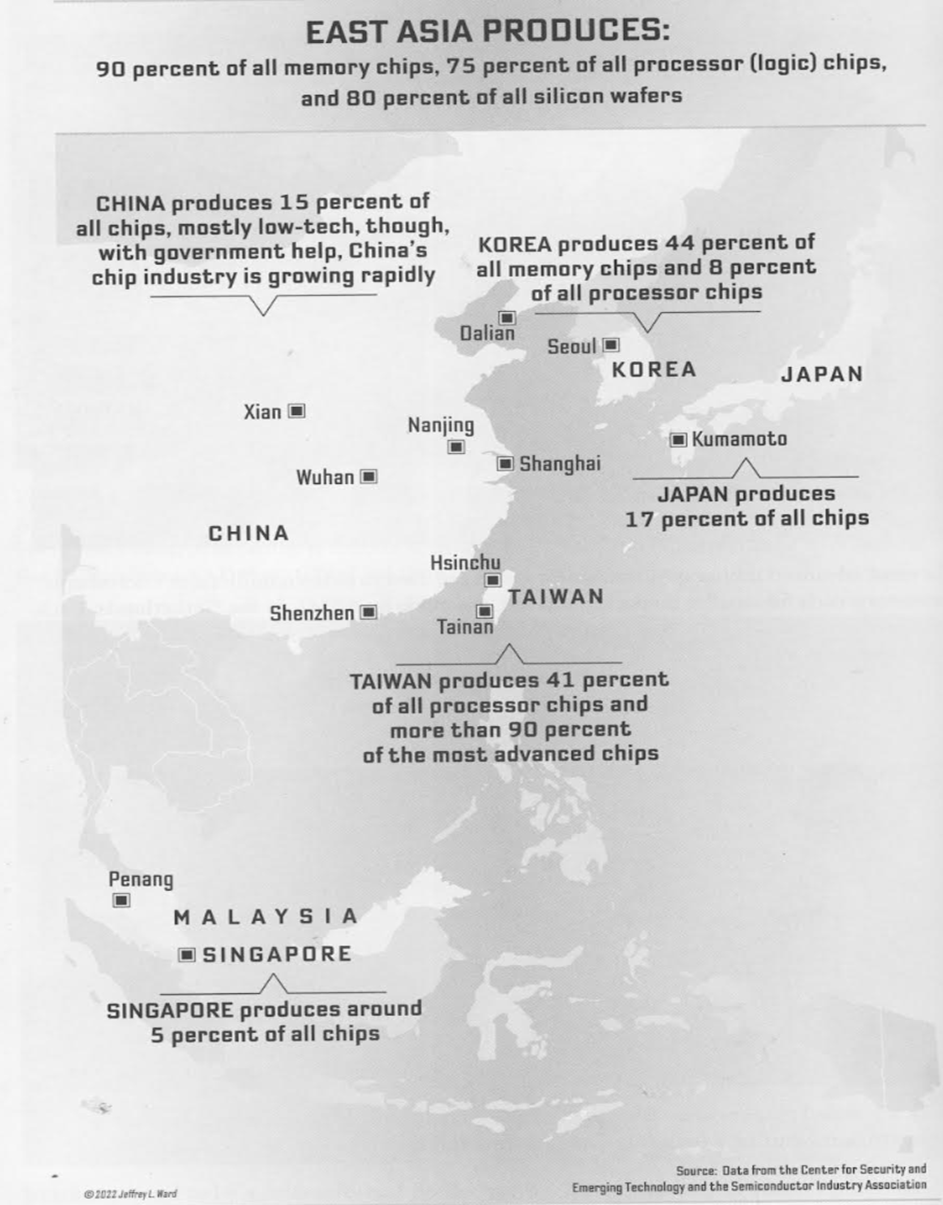

The network of chip production is thus highly disparate, with factories scattered between the Netherlands, the US, Taiwan, South Korea, Japan, Malaysia (though note the cluster of firms based in East Asia, as shown by the map above). It is also concentrated in a handful of quasi-monopolies (ASML for ultraviolet lithography, Intel for microprocessors, Nvidia for GPUs, TSMC and Samsung for actual production), with monumental levels of investment. This is the web which makes US sanctions so effective: an American monopoly on microchip designs, drawn up by its great ‘fabless’ firms, through which enormous leverage can be wielded against companies in vassal states which actually manufacture the materials. The US can effectively block Chinese technological progress because no country in the world has the competence or resources necessary to develop these sophisticated systems. The US itself must rely on technological infrastructure developed in Germany, Britain and elsewhere. Yet this is not merely a question of technology; trained engineers, researchers and technicians are also necessary. For China, then, the mountain to climb is steep, even vertiginous. If it manages to procure a component, it will find that another is missing, and so on. In this sector, technological autarky is impossible.

Beijing naturally sought to prepare itself for this eventuality, having foreseen the arrival of these restrictions for some time, by both accumulating chips and investing fantastical sums in the development of local chip-manufacturing technology. It has made some progress in production: the Chinese company Semiconductor Manufacturing International Corporation (SIMC) now produces chips, though its technology lags behind TSMC, Samsung and Intel by several generations. But, ultimately, it will be impossible for China to catch up with its competitors. It cannot access lithographic machines nor the extreme ultraviolets provided by ASML, which has blocked all exports. China’s impotence in the face of this attack is clear from the total lack of official response from Beijing officials, who have not announced any countermeasures or reprisals for American sanctions. The preferred strategy seems to be dissimulation: continuing to work under the radar (perhaps with a little espionage), rather than being thrown out to sea without a flotation device.

The problem for the American blockade is that a large proportion of TSMC’s exports (plus those of Samsung, Intel and ASML) are bound for China, whose industry depends on the island it wants to annex. The Taiwanese are fully aware of the pivotal role of the semiconductor industry in their national security, so much so that they refer to it as their ‘silicon shield’. The US would do anything to avoid losing control over the industry, and China can’t afford the luxury of destroying its facilities with an invasion. But this line of reasoning was far more robust before the outbreak of the current Cold War between the US and China.

In fact, two months prior to the announcement of microchip sanctions on China, the Biden administration launched a Chip and Science Act which allocated $50 billion to the repatriation of at least part of the production process, practically forcing Samsung and TSMC to build new manufacturing sites (and upgrade old ones) on American soil. Samsung has since pledged $200 billion for eleven new facilities in Texas over the next decade – although the timeline is more likely to be decades, plural. All this goes to show that if the US is willing to ‘deglobalize’ some of its productive apparatus, it’s also extremely difficult to decouple the economies of China and the US after almost forty years of reciprocal engagement. And it will be even more complicated for the US to convince its other allies – Japan, South Korea, Europe – to disentangle their economies from China’s, not least because these states have historically used such trading ties to loosen the American yoke.

The textbook case is Germany: the biggest loser in the war in Ukraine, a conflict which has called into question every strategic decision pursued by German élites in the last fifty years. Since the turn of the millennium, Germany has grounded its economic – and therefore political – fortunes in its relationship with China, its principal commercial partner (with $264 billion worth of annual trade). Today, Germany continues to strengthen these bilateral ties, despite both the cooling of relations between Beijing and Washington and the ongoing war in Ukraine, which has disrupted Russian intermediation between the German bloc and China. In June, the German chemicals producer BASF announced an investment of $10 billion in a new plant in Zhangjiang in the south of China. Olaf Scholz even made a visit to Beijing earlier this month, heading a delegation of directors from Volkswagen and BASF. The Chancellor came bearing gifts, pledging to approve the Chinese company Cosco’s controversial investment in a terminal for container ships in the port of Hamburg. The Greens and Liberals objected to this move, but the Chancellor responded by pointing out that Cosco’s stake would be around 24.9%, with no veto rights, and would cover only one of Hamburg’s terminals – incomparable to the company’s outright acquisition of Piraeus in 2016. In the end, the more Atlanticist wing of the German coalition was forced to give way.

In the present conjuncture, even these minimal gestures – Scholz’s trip to Beijing, less than $50 million worth of Chinese investment in Hamburg – seem like major acts of insubordination, especially following the latest round of American sanctions. But Washington couldn’t have expected its Asian and European vassals to simply swallow deglobalization as if the neoliberal era had never happened: as if, during recent decades, they hadn’t been encouraged, pushed, almost forced to entwine their economies with one another, building a web of interdependence which is now exceedingly difficult to dismantle.

On the other hand, when war breaks out, vassals must decide which side they’re on. And this is shaping up to be a gigantic war, even if it’s fought over millionths of millimetres.

Read on: Susan Watkins, ‘America vs China’, NLR 115.