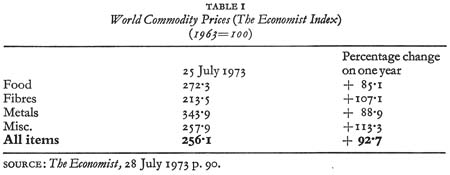

In the past year the price of primary commodities has nearly doubled. The extent of the boom in 1973 is glaringly obvious from a survey of the major commodity indices:

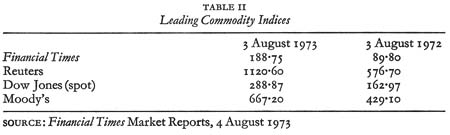

The other leading indicators also show the explosive character of the boom:

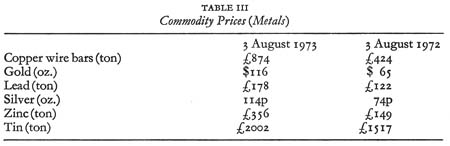

A commodity-by-commodity examination confirms the basic accuracy of the indices; only aluminium, wolfram, nickel and mercury have not shown a sharp rise during the course of the last year:

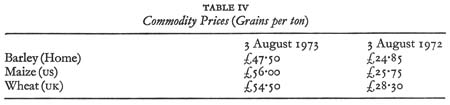

The level of grain prices (shown in table iv) does not reflect the recent

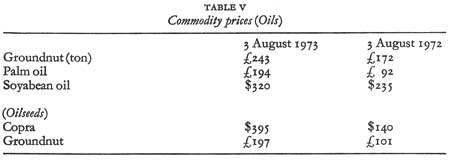

The prices of us and Canadian wheats have climbed throughout the 1972–3 crop season, the price of soya beans and oilcakes has doubled, while fishmeal (another major protein source) for the animal feed industry is virtually unobtainable after the failure of Peruvian production. The worldwide shortage of protein is reflected in the oilseed and vegetable oil prices shown in table v:

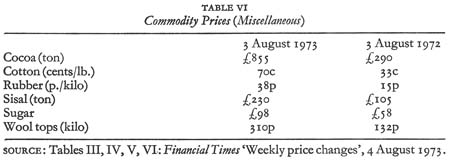

The prices of the other major traded commodities have either remained steady such as coffee, tea, jute and sulphur or risen drastically as table vi shows:

The distribution of gains has covered the whole of the undeveloped world from Zambia (copper) to Sri Lanka (rubber and coconut oil). Prices have risen in every major commodity group: grains, beverages, oils and oilseeds, fibres, metals and fuels. The gains to individual developing economies will differ enormously, but there is little doubt that the poorer capitalist world as a whole has gained substantially in 1973 and will gain in succeeding years. For unless there is a really major recession the present set of increases in the price of commodities is most unlikely to be wiped out in the period up to 1980.